Are you a Veteran? Find out how you can purchase a home using your VA benefit!

Eligibility

To be eligible for a VA Loan, veterans, active duty service members, National Guard members and reservists must meet the basic service requirements set forth by the Department of Veterans Affairs. Spouses of military members who died while on active duty or as a result of a service-connected disability may also be eligible.

It’s ultimately up to the VA to determine eligibility for the home loan program, but prospective borrowers can get a good idea by looking at the VA’s basic eligibility guidelines.

You may be eligible for a VA Home Loan if you meet one or more of the following conditions:

- You have served 90 consecutive days of active service during wartime, OR

- You have served 181 days of active service during peacetime, OR

- You have more than 6 years of service in the National Guard or Reserves, OR

- You are the spouse of a service member who has died in the line of duty or as a result of a service-related disability.

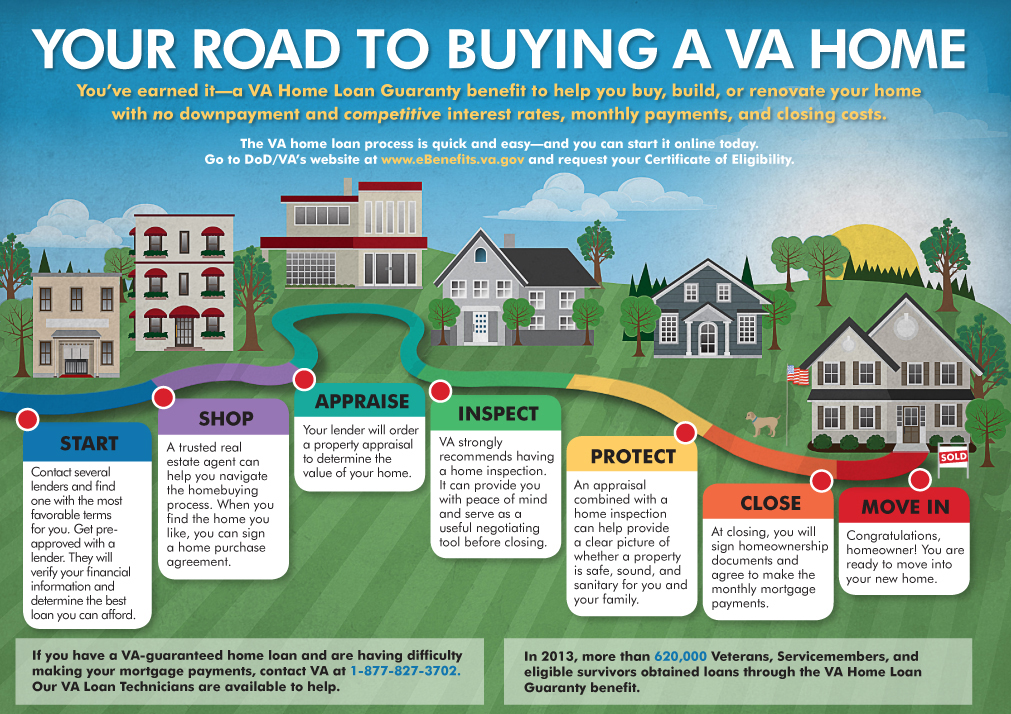

Buying Process

How to Apply for a VA Loan Certificate of Eligibility (COE)

While you don’t need your VA Certificate of Eligibility in hand to start the loan process with Veterans United, this certificate is a very important part of your loan application. Your COE verifies that your length and character of service make you eligible to use the VA home loan benefit.

You can apply for a VA Loan Certificate of Eligibility three different ways:

- Apply through a VA approved lender

- Apply online through the VA’s eBenefits portal

- Apply by mail with VA Form 26-1880

Get a Certificate of Eligibility

The Certificate of Eligibility (COE) verifies to the lender that you meet the eligibility requirements for a VA loan. Learn more about the evidence you submit and how to apply for a COE on our Eligibility page.

Find a Home and Sign a Purchase Agreement

Work with a real estate professional and negotiate a purchase agreement. Make sure the purchase and sales agreement contains a “VA Option Clause.”

Here’s a sample of a “VA Option Clause”:

“It is expressly agreed that, notwithstanding any other provisions of this contract, the purchaser shall not incur any penalty by forfeiture of earnest money or otherwise be obligated to complete the purchase of the property described herein, if the contract purchase price or cost exceeds the reasonable value of the property established by the Department of Veterans Affairs. The purchaser shall, however, have the privilege and option of proceeding with the consummation of this contract without regard to the amount of the reasonable value established by the Department of Veterans Affairs.”

You may also want the purchase agreement to allow you to “escape” from the contract without penalty if you can’t get a VA loan.

Apply for your VA Loan

Work with the lender to complete a loan application and gather the needed documents, such as pay stubs and bank statements.

Loan Processing

How to Apply

Purchase Loan & Cash-Out Refinance: VA loans are obtained through a lender of your choice once you obtain a Certificate of Eligibility (COE). You can obtain a COE through eBenefits, by mail, and often through you lender. Learn More

Interest Rate Reduction Refinance Loan: A new Certificate of Eligibility (COE) is not required. You may take your Certificate of Eligibility to show the prior use of your entitlement or your lender may use our e-mail confirmation procedure in lieu of a certificate of eligibility. Learn More

Native American Direct Loan (NADL) Program: First, confirm that your tribal organization participates in the VA direct loan program. NADL loans are obtained through a lender of your choice once you obtain a Certificate of Eligibility (COE). You can obtain a COE through eBenefits, by mail, and often through you lender. Learn More

Adapted Housing Grants: You can apply for an SAH or SHA grant by either downloading and completing VA Form 26-4555 (PDF) and submitting it to your nearest Regional Loan Center, or completing the online application. Learn More

Closing

The lender chooses a title company, an attorney, or one of their own representatives to conduct the closing.

Loan Fees

VA Funding Fee

Generally, all Veterans using the VA Home Loan Guaranty benefit must pay a funding fee. This reduces the loan’s cost to taxpayers considering that a VA loan requires no down payment and has no monthly mortgage insurance. The funding fee is a percentage of the loan amount which varies based on the type of loan and your military category, if you are a first-time or subsequent loan user, and whether you make a down payment. You have the option to finance the VA funding fee or pay it in cash, but the funding fee must be paid at closing time.

You do not have to pay the fee if you are a:

- Veteran receiving VA compensation for a service-connected disability, OR

- Veteran who would be entitled to receive compensation for a service-connected disability if you did not receive retirement or active duty pay, OR

- Surviving spouse of a Veteran who died in service or from a service-connected disability

The funding fee for second time users who do not make a down payment is slightly higher. Also, National Guard and Reserve Veterans pay a slightly higher funding fee percentage. To determine your exact percentage, please review the latest funding fee chart.

Other Loan Costs

Be aware that the lender charges interest, in addition to closing fees and charges. Here are some general rules:

- The lender, not VA, sets the interest rate, discount points, and closing costs. These rates may vary from lender to lender

- Closing costs such as the VA appraisal, credit report, state and local taxes, and recording fees may be paid by the purchaser, the seller, or shared

- The seller can pay for some closing costs. (Under our rules, a seller’s “concessions” can’t exceed 4% of the loan. But only some types of costs fall under this 4% rule. Examples are: payment of pre-paid closing costs, VA funding fee, payoff of credit balances or judgments for the Veteran, and funds for temporary “buydowns.” Payment of discount points is not subject to the 4% limit.)

- You are not allowed to pay for the termite report, unless the loan is a refinance. That fee is usually paid by the seller.

- No commissions, brokerage fees, or “buyer broker” fees may be charged to the Veteran buyer

Adding the VA Funding Fee and other loans costs to your loan may result in a situation in which you owe more than the fair market value of the house, and will reduce the benefit of refinancing since your payment will not be lowered as much as it could be. Also, you could have difficulty selling the house for enough to pay off your loan balance.