By Amanda Finnegan

There are rules to a liquidation sale, you know. Just because you are guarding that prime rib cart, that doesn’t make it yours. And there’s no bargaining or bartering, either — at least not on the first day.

But one of the foremost rules at the Sahara liquidation sale Thursday were words that probably had never been spoken inside the Sahara in its 58-year history.

“There is no smoking,” Don Hayes, who is overseeing the sale for National Content Liquidators, boomed over the microphone as the first buyers began to trickle in.

To protect the artifacts, of course.

More than 600,000 items were up for grabs at the first day of the two-month liquidation sale at the closed Sahara Hotel, which shut its doors just a month ago. That includes every dish, piece of silverware, housekeeping vacuum and toilet, yet another sign that a wrecking ball will most likely be the next patron to enter the empty Strip property.

Hopeful buyers lined up during the early morning hours Thursday to grab a piece of one of the last standing casinos from Las Vegas’ early boom years. The line started at the entrance of the Sahara and stretched to Paradise Road.

Hours into it, buyers were still waiting outside in the heat to get a glimpse of what was for sale inside.

Some buyers came on a mission with a particular piece in mind, heading straight for the black and white posters of Elvis or Johnny Carson, while others browsed and stocked up on framed prints from the hotel rooms, slot machine chairs and waste baskets.

Louis Bowl of Barstow, Calif., and his family scooped a frame photo of Elvis during one his visits to the Sahara and two poker tables.

“We headed over here about 6 a.m. and were the 40th in line. We’re looking for collectibles and a poker table,” Bowls said.

No more than an hour later, his family had a corner sectioned off with the casino floor with scores of items, and they were still going. Bowls said his group didn’t have a price limit.

The priciest item on the casino floor was the currency change desk at the casino cage, priced at $28,000. Next might have been one of Sahara’s famous camels, which everyone talked about but no one could afford at $12,000.

Even though most of the more memorable, moderately priced items were gone within the first few hours of the sale, Greg Hall, operations director for the sale, said they expect the sale to go the full 60 days.

“It’s going fantastic. Things are running smooth, everything’s going good, and we’ve got a great crowd,” Hall said about the first day of the sale.

He reported no scuffles on the sale floor so far, all accept for a small argument over a fake tree between two groups hoarding their loot on opposite sides of the casino floor.

But the hot-ticket items of the day were the camel lamps from the rooms. Priced at $150 a piece, buyers headed to the cashier set up at the registration desk with armfuls of the 700-of-a-kind, only-at-Sahara piece. Mary Lane Slack of Las Vegas wheeled a cart full of the camel lamps to the cashier, grabbing a piece of a casino she remembers as a glitzier place during her childhood.

Slack’s mother ran a children’s shop across the street from the Sahara called Small Fry, which she said was frequented by the stars who performed at the Sahara.

“The sale is fun, but it’s really sad. I can remember coming down here for dinner with my parents as a kid. The whole thing is sad because it seems like they are going to tear it down,” Slack said.

The lamps were all Slack had time to grab, but she said she still had her eye on a karaoke sign in one of the lounge areas for nostalgia’s sake.

Upstairs, buyers sized up the Sahara’s presidential and admiral suites and their early 1990s furnishings. The suites seemed more like a place where furnishings went to get a second life rather than luxury hotel rooms, with mismatched artwork hanging from the walls and worn throw rugs thrown over even more worn carpeting.

Other items for sale in the suites included bidets for $75, sink vanities for $200, $100 for artwork and $250 brass embellished doors, reading “presidential suite.”

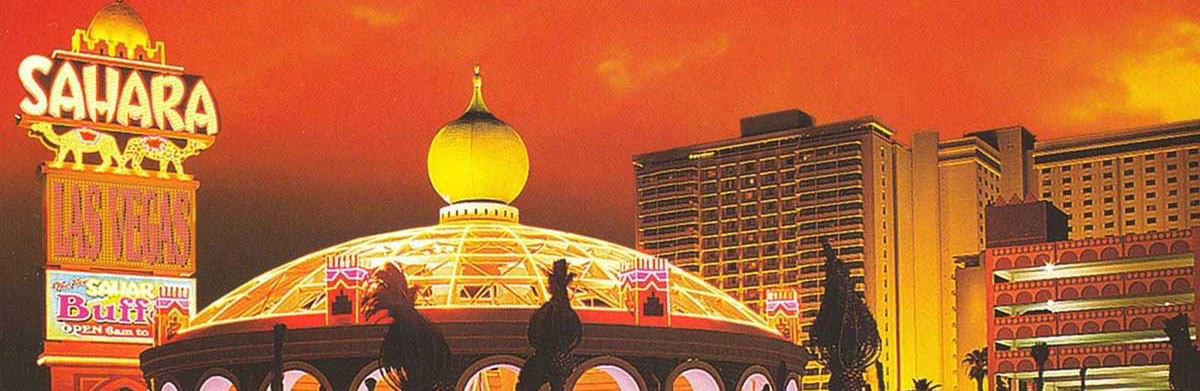

Potential shoppers wait in line just before the opening of the first day of the Sahara liquidation sale Thursday, June 16, 2011. Nearly every item is for sale and were priced and sold as is, where is and on a first come basis.

But cassette player stereo systems and the mirrors over the beds in the suites didn’t have price tags. Their value must have been immeasurable.

Bob and Shirley Barrett of North Las Vegas, both in their Sahara T-shirts from the casino’s final days, browsed through the suites looking for flat-screen TVs. They didn’t find any, so instead settled on a $15 phone, a sign from the Golden Room and another from the casino floor.

The Barretts have been going to liquidation sales at closed casinos for the past 11 years, collecting pieces such as 350-pound neon signs from the Boardwalk hotel for their living room and another from the Paradise Café at the Stardust, which hangs in their kitchen.

“We just wanted to add one sign from the Sahara,” Bob Barrett said. “We moved here in 1999 and the first sale we went to was the El Rancho liquidation. We just started decorating our home that way because we love Vegas. We brought stuff from Massachusetts, but we didn’t fill the house. It’s full now.”

But Shirley Barrett would like everyone to know, “We aren’t hoarders or anything. Just collectors.”

She said she had her eye on the fake marble tub in the center of the master bedroom in the Admiral Suite, but the couple would have to pry it off the worn carpeting themselves.

Like other pieces bolted down at the Sahara, it would cost much more than its $450 price tag to have it removed and hauled out, and probably much more than its actual worth.